Find A Perfect Deal To Invest In Dubai

Discover ideal investment opportunities in real estate across Dubai, offering a diverse range of properties, including luxurious apartments, exquisite villas, and sophisticated penthouses.

Get Started

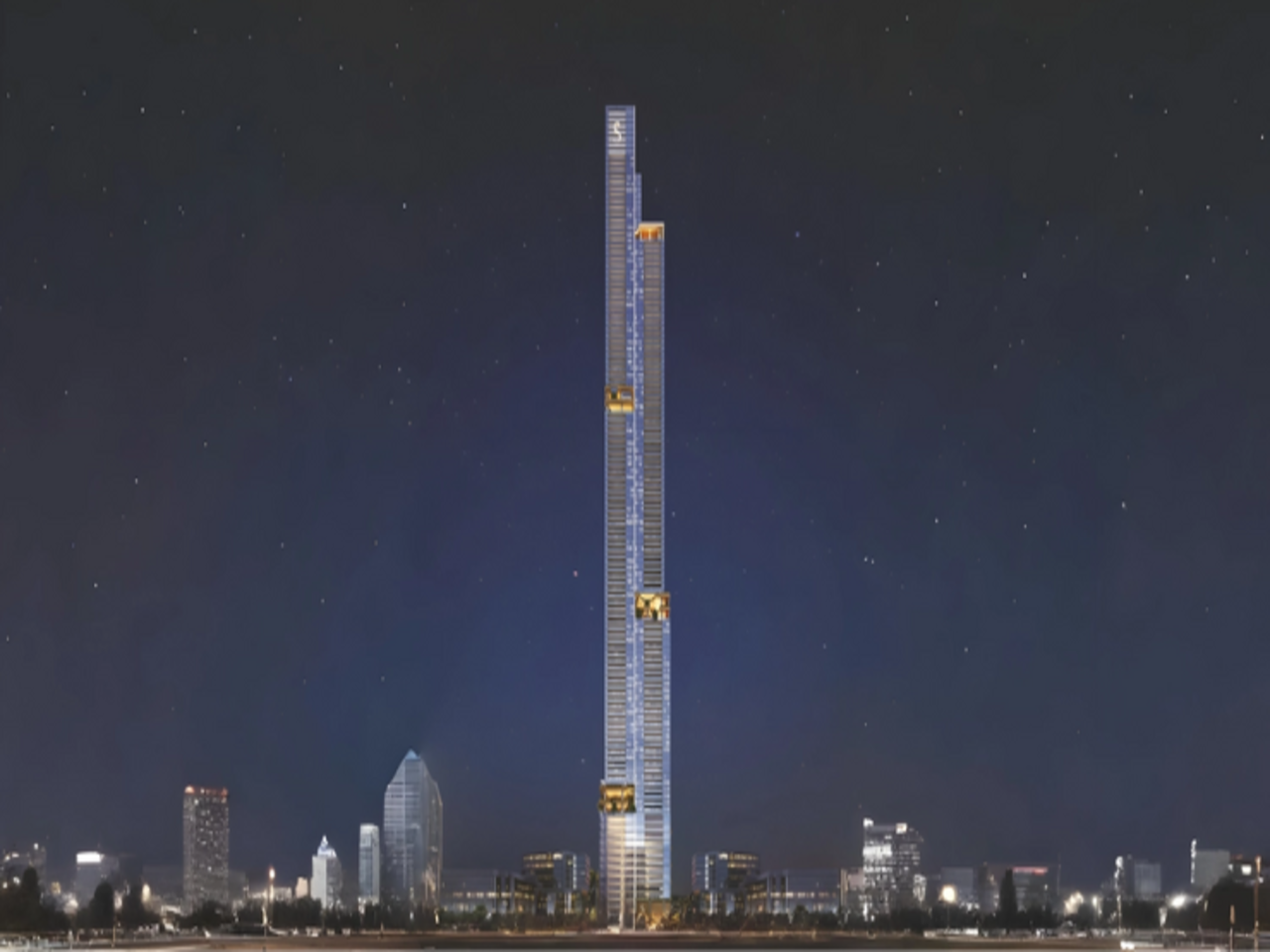

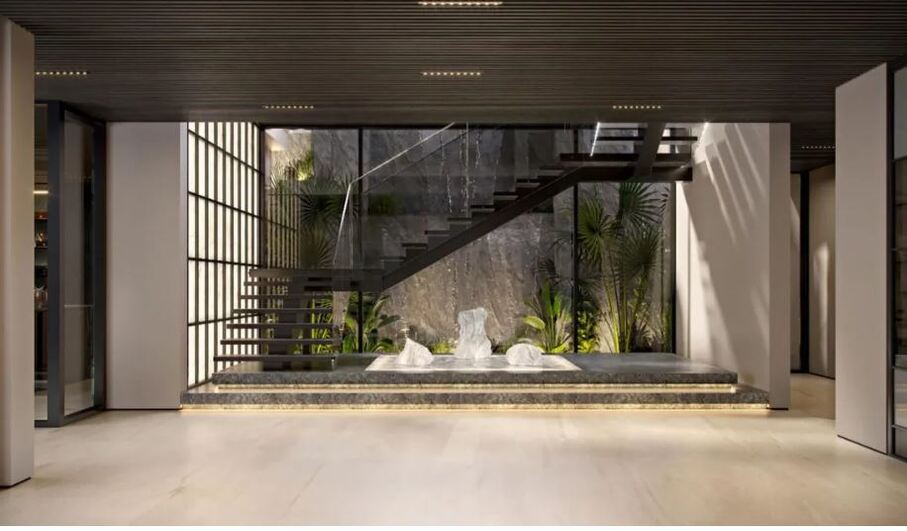

AED 2.79M | USD 753K | ₹6.502C

Business Bay | Qube Development

Bed: 1,2,3&4

Our Clients Reviews!

Our clients' reviews showcase their satisfaction and experiences with our real estate services in Dubai, reflecting our commitment to excellence in the industry.

Sona was a delightful and pleasant human being to deal with. The experience was bar none and she made the whole process seamless. She wasn't a pushy saleswoman but caring, understanding and forthright. Anyone that has her as their representative will have a win win experience. Thanks Sona.

Jeff Mathew

ClientI'm greatful for a successful and professional sale with the agent Sona, she's very knowledgeable and helpful and having good connections to close the deal, the best agent to deal with from both professional and personal sides.

Johnny Chalhoub

ClientThank you Sona Idiculay for all your help in selling our home. Your knowledge in the property market, attention to detail made the process easy and lucrative for us, and we couldn't be happier we chose you to list our property.

Payal Bhatia

ClientSona Idiculay is one of the genuine real estate person in Dubai. Very honest advice and opinion. Sona keeps the clients interest at forefront. Had a very good experience with her in selling and then buying a property. She went out of way to get the best possible deals both times.

Kishore Bhatia

ClientI had an amazing experience with Sona who had assisted me in purchase. I was new here and she was very kind and I could trust her . She never approached as a typical person who would bother or push rather very patient and really gave us time and space. If ever again my next purchase or sale I highly recommend Sona and once again thank u for ur assistance.

Smita Kumari

ClientFirst we would like to thank Keyhunters for the hard work and dedication and a big thanks for Ms. Sona and her expertise , Working with her feels like a safety journey to succeed, thank you Sona for your efforts we really appreciate it.

Zaid Al Daya (Sales Manager) Al Marwan Developments

ClientSo Professional and trustful person.

Amr Al Daya ( Sales Director/Forest Hills Real Estate)

ClientWe bought one property through Sona and I can say that the way of working is entirely different that other typical real estate firm. They will stand with you on each and every step and you feel like some one very near and dear is working for you. I highly recommend them to fulfill your real estate dreams.

Manju Mohan

ClientThe best real estate agent you can get in Dubai. Sona has the very good market knowledge, responsive & absolutely professional. She will help you find the best project, either its for live in or for investment. Sona has a strong network & is thorough with all the processes from the start to finish. I’m fully satisfied that I made a right choice with “Key hunters real estate”. Keep up the great work Sona! All the best!

Megha Arshad

ClientFrequently Asked Question

1. Dubai Land Department (DLD) Fees:

• Transfer Fee: 4% fee of the property price is typically charged by the DLD.

• Admin Fee: An additional admin fee is charged, ranging from AED 580 for apartments and offices to AED 430 for land.

2. Property Registration Fees:

• For properties valued below AED 500,000: AED 2,000 + 5% VAT.

• For properties valued above AED 500,000: AED 4,000 + 5% VAT.

3. Real Estate Agent Fees:

• Commission: Generally, agents charge a commission of 2% of the purchase price, plus 5% VAT.

4. Mortgage-Related Fees (if applicable):

• Mortgage Arrangement Fee: Banks typically charge a fee of 1% of the loan amount.

• Mortgage Registration Fees: Dubai Land Department charges 0.25% of the loan amount, plus AED 290.

• Property Valuation Fee: A fee of AED 2,500 - AED 3,500 (plus VAT) is charged for property valuation.

• Conventional Mortgages:

o Offered at fixed or variable interest rates.

o Suitable for those seeking predictable monthly payments.

• Islamic Mortgages (Murabaha and Ijara):

o Compliant with Sharia law.

o Murabaha: Bank buys the property and sells it to the buyer at a profit.

o Ijara: Bank buys the property and leases it to the buyer

o Typically ranges from 20% to 25% of the property value, depending on the applicant's residency status and the property's location.

• Debt-to-Income Ratio (DTI):

o Most banks require that the total monthly debt obligations (including the mortgage) do not exceed 50% of the applicant's monthly income.

• Credit Score:o

o A minimum score of 600 is typically required for mortgage approval.

• Processing Time:

o Mortgage processing for salaried individuals typically takes 7–10 days, while for self-employed individuals, it may take 15–20 days due to additional documentation and verification requirements.

o Valid for 45–65 days.

Eligibility Criteria:

• Annual Turnover: Minimum AED 3,000,000.

• Age:

o Minimum 30 years at the time of application.

o Maximum 70 years at the time of loan maturity.

• Property Location: Eligible for properties located in Abu Dhabi and Dubai only.

Required Documents:

1. Valid passport and Emirates ID.

2. Valid UAE residence visa (for expatriates).

3. Khulasat Al Qaid (Family Book) for UAE nationals.

4. Trade license.

5. Memorandum of Association (MOA), including all amendments.

6. Audited financial statements for the last 2 years.

7. Company bank statements for the last 6 months.

8. Personal bank statements for the last 6 months.

9. Liability letter (if applicable).

10. Property ownership documents/(MOU)

Eligibility Criteria:

• Minimum Salary:

o AED 10,000 per month for salary transfer customers.

o AED 15,000 per month for non-salary transfer customers.

• Age:

o Minimum 21 years at the time of application.

o Maximum 70 years for UAE nationals and 65 years for expatriates at the time of loan maturity.

• Property Location: Eligible for properties located in all Emirates.

Required Documents:

1. Valid passport and Emirates ID.

2. Valid UAE residence visa (for expatriates).

3. Khulasat Al Qaid (Family Book) for UAE nationals.

4. Salary certificate (issued within the last 30 days).

5. Bank statements for the last 3–6 months.

6. Liability letter (if applicable).

7. Property ownership documents /(MOU)

1. Tax-Free Investment

• Dubai is a tax-free environment for property investors:

• No tax on rental income or no capital gains tax on property sales.

• No annual property taxes for residential properties This tax structure maximizes your net returns and reduces the cost of ownership.

2. High Rental Yields

Averaging rental yields is between 6% and 8%, with some areas providing even higher returns. The city's growing population and influx of tourists contribute to strong demand for rental properties.

3. Golden Visa Residency

UAE Golden Visa by investing in property worth at least AED 2 million. This long-term residency visa, valid for 10 years, allows investors to sponsor family members and provides a pathway to permanent residency.

4. Robust Economic Growth

Dubai's diversified economy, encompassing sectors like tourism, trade, logistics, and finance, ensures economic resilience. The World Bank projects a 4.1% GDP growth for the UAE in 2025, reflecting a stable and growing economy.

5. World-Class Infrastructure

Dubai is renowned for its advanced infrastructure, including state-of-the-art transportation systems, modern healthcare facilities, and top-tier educational institutions. Ongoing developments, such as the Expo 2020 site and Dubai Creek Harbour, further enhance the city's appeal.

6. Regulated Real Estate Market

The Dubai Land Department (DLD) and the Real Estate Regulatory Agency (RERA) oversee the real estate market, ensuring transparency and protecting investors' rights. This regulatory framework fosters a secure investment environment.

7. Strategic Global Location

Situated between Europe, Asia, and Africa, Dubai serves as a global business and travel hub. Its strategic location facilitates international trade and connectivity, enhancing its attractiveness for investors.

8. Diverse Property Options

Dubai's real estate market offers a wide range of properties, from luxurious villas and upscale apartments to commercial spaces and off-plan developments. This diversity allows investors to choose properties that align with their investment goals and preferences